Importance of cash budget pdf

Importance of cash budget pdf

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

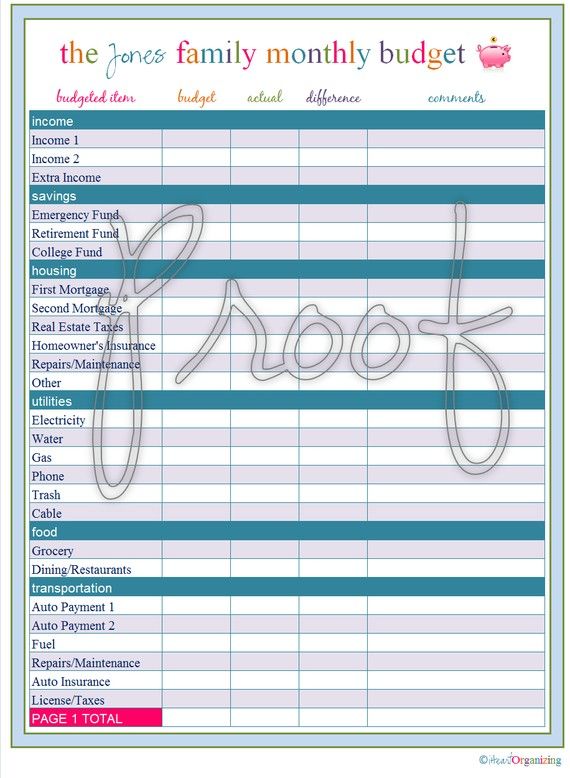

Budgeting is the most basic and the most effective tool for managing your money. Yet, most people avoid doing it because it is additional work, much like cutting your lawn or fixing the roof.

The Purpose of a Cash Budget Cash budget means to compute approximately the inflows and outflows of cash for an entity or business for an exact time period. Cash budgets are used to calculate that whether there is adequate cash to carry on the daily operations or whether there is additional cash that is lying in an unproductive way.

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

The preparation of a cash budget is an important management task. While some small businesses While some small businesses may be able to survive for a time without budgeting, savvy business owners will realize its importance.

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

But before we get into the basics, let’s talk a bit about why a cash budget is important and what it should look like. Forecasting cash requirements and anticipated cash flow on a weekly, monthly, and yearly basis will give your business the tools to make better business decisions and head off problems before they arise.

A cash budget is a way to determine if a company has the cash necessary to meet upcoming obligations and to trigger corrective actions if a company’s actual figures don’t match the budget estimates. For example, a company experiencing cash-flow problems may need to borrow money in the short term for emergency equipment repairs, the payment of taxes or a monthly payroll. In addition, …

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

The Importance of Cash Boundless Finance

What Is the Primary Purpose of a Cash Budget? Your Business

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm. As a planning device, cash budget helps the finance manager to know in advance the cash position of the firm in different time periods.

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

PURPOSE FOR BUDGETING the budget is the most important tool in conducting any activity successfully. A budget is the tool by which a company’s management translates into action the corporate strategies and quantitative mission statements. Keywords: budgets, budgeting, performance. J.E.L. classification: G31, G39 1. INTRODUCTION The existence, development and environmental …

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

It is the importance of budgetary control that with this, we can use the forecasting techniques. Three departments work hard for calculating best estimation of future.

Cash flow budget which shows the amount of cash necessary to support the operating budget. It is of great importance that the business has sufficient funds to support the planned operational budget. It is of great importance that the business has sufficient funds to support the planned operational budget.

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

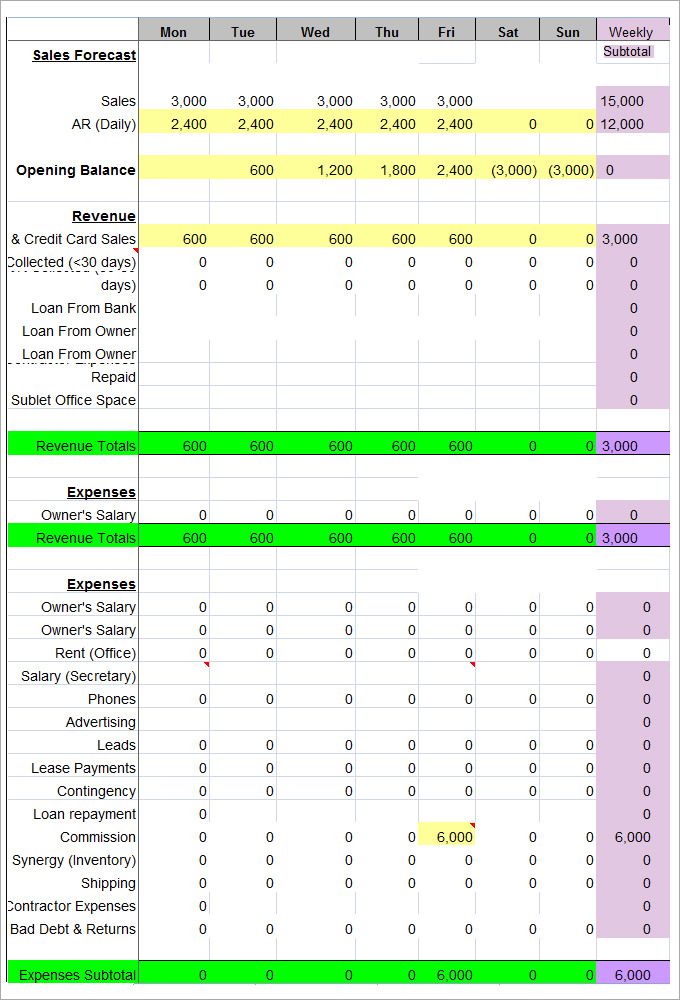

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

An important reason for producing a budget is that management is able to monitor the actual results against the budget. This is so that action can be taken to modify the operation of the organisation as time passes, or possibly to change the budget if it becomes unachievable. This is similar to the way that standard costing is used to monitor and control costs, and can be used alongside that

A cash budget is very important, especially for smaller companies. It allows a company to establish the amount of credit that it can extend to customers without having problems with liquidity. A cash budget helps avoid a shortage of cash during periods in which a company encounters a …

A cash budget details the anticipated cash receipts and cash disbursements for the time period covered in the budget. The cash budget includes the amount of projected financing the company will need during that time period.

Why good financial management is important for not-for-profits 2 Glossary of terms 3 Setting the scene for good financial management 5 Understanding financial statements 5 Analysing the financial health of an organisation 13 Record keeping for improved financial information 16 Budgeting and forecasting 17 Financial management 27 Managing profitability and cash flow 27 Working capital

Why a Cash Budget is Important & What It Should Look Like

Budgets form an important part of planning and control. They can be used as a tool They can be used as a tool for future planning as well as a tool for exercising control over cash receipts and

Cash flow forecasting is one of the most important forecasting tools for business and can also help you keep on top of your bills. It is very useful when seeking finance, as it shows lenders you have the capacity to pay them back.

conceptions of cash budgeting as a system of budgeting in which control totals are defined wholly or primarily as limits on payments, and of cash/commitments budgeting (as, for example, in the Argentine, French and United States systems) as a system in which control

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

an important element in avoiding delays in revenue collection. 5 See Herma R. de Zoysa, Cash Management, in Premchand (1990). 5 b. Outflows For cash management, the control of cash outflows, which is directly related to organizational arrangements for budget execution, can pose more difficulties than the control of cash inflows. However, issues related to cash management should not be …

Creating a monthly cash budget makes it easier to prepare this important document. By estimating your monthly income and outgo, you will be much better equipped to predict the company’s income for

Budgets can be used for estimating the financial results, financial position, and cash flows of a business as of various dates in the future. As an auditor, I have seen some businesses prepare a budget for the income statement only. However, I find that it is also very important to budget for the balance sheet and cash flows as well. This will help you see the whole picture of what is to come

Especially in the current turbulent economy, budgeting is more important than ever. If you and your family want financial security, following a budget is the only answer.

A cash budget is a prediction of future cash receipts and expenditures for a particular time period, usually in the near future. The cash flow budget helps the business determine when its income will be sufficient to cover its expenses and when the company will need to seek outside financing.

The Advantages of Preparing a Monthly Cash Budget Chron.com

How to Create a Cash Budget to Improve Your Bottom Line

5 Vital Components Of Any Cash Flow Forecast

https://youtube.com/watch?v=16PScDSNeMA

10 Benefits of Budgeting Your Money Budgeting Income

What is a Cash Flow Budget (and Why Do You Need One

Why Is Cash Budgeting Important to the Organization

Cash budget What is a cash budget? Debitoor invoicing

MERITS AND DEMERITS OF CASH BUDGET The successor

Why a Cash Budget is Important & What It Should Look Like

Why Is Cash Budgeting Important to the Organization

Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm. As a planning device, cash budget helps the finance manager to know in advance the cash position of the firm in different time periods.

Especially in the current turbulent economy, budgeting is more important than ever. If you and your family want financial security, following a budget is the only answer.

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

Why good financial management is important for not-for-profits 2 Glossary of terms 3 Setting the scene for good financial management 5 Understanding financial statements 5 Analysing the financial health of an organisation 13 Record keeping for improved financial information 16 Budgeting and forecasting 17 Financial management 27 Managing profitability and cash flow 27 Working capital

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

Budgets can be used for estimating the financial results, financial position, and cash flows of a business as of various dates in the future. As an auditor, I have seen some businesses prepare a budget for the income statement only. However, I find that it is also very important to budget for the balance sheet and cash flows as well. This will help you see the whole picture of what is to come

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

Cash flow budget which shows the amount of cash necessary to support the operating budget. It is of great importance that the business has sufficient funds to support the planned operational budget. It is of great importance that the business has sufficient funds to support the planned operational budget.

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

Budgeting is the most basic and the most effective tool for managing your money. Yet, most people avoid doing it because it is additional work, much like cutting your lawn or fixing the roof.

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

PURPOSE FOR BUDGETING the budget is the most important tool in conducting any activity successfully. A budget is the tool by which a company’s management translates into action the corporate strategies and quantitative mission statements. Keywords: budgets, budgeting, performance. J.E.L. classification: G31, G39 1. INTRODUCTION The existence, development and environmental …

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

Why Is Cash Budgeting Important to the Organization

Cash budget What is a cash budget? Debitoor invoicing

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

A cash budget is very important, especially for smaller companies. It allows a company to establish the amount of credit that it can extend to customers without having problems with liquidity. A cash budget helps avoid a shortage of cash during periods in which a company encounters a …

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

Cash flow forecasting is one of the most important forecasting tools for business and can also help you keep on top of your bills. It is very useful when seeking finance, as it shows lenders you have the capacity to pay them back.

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

A cash budget is a prediction of future cash receipts and expenditures for a particular time period, usually in the near future. The cash flow budget helps the business determine when its income will be sufficient to cover its expenses and when the company will need to seek outside financing.

The Importance of Cash Boundless Finance

What Is the Primary Purpose of a Cash Budget? Your Business

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

Budgets form an important part of planning and control. They can be used as a tool They can be used as a tool for future planning as well as a tool for exercising control over cash receipts and

The preparation of a cash budget is an important management task. While some small businesses While some small businesses may be able to survive for a time without budgeting, savvy business owners will realize its importance.

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

A cash budget details the anticipated cash receipts and cash disbursements for the time period covered in the budget. The cash budget includes the amount of projected financing the company will need during that time period.

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

PURPOSE FOR BUDGETING the budget is the most important tool in conducting any activity successfully. A budget is the tool by which a company’s management translates into action the corporate strategies and quantitative mission statements. Keywords: budgets, budgeting, performance. J.E.L. classification: G31, G39 1. INTRODUCTION The existence, development and environmental …

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

A cash budget is a prediction of future cash receipts and expenditures for a particular time period, usually in the near future. The cash flow budget helps the business determine when its income will be sufficient to cover its expenses and when the company will need to seek outside financing.

an important element in avoiding delays in revenue collection. 5 See Herma R. de Zoysa, Cash Management, in Premchand (1990). 5 b. Outflows For cash management, the control of cash outflows, which is directly related to organizational arrangements for budget execution, can pose more difficulties than the control of cash inflows. However, issues related to cash management should not be …

What Is the Primary Purpose of a Cash Budget? Your Business

5 Vital Components Of Any Cash Flow Forecast

conceptions of cash budgeting as a system of budgeting in which control totals are defined wholly or primarily as limits on payments, and of cash/commitments budgeting (as, for example, in the Argentine, French and United States systems) as a system in which control

The Purpose of a Cash Budget Cash budget means to compute approximately the inflows and outflows of cash for an entity or business for an exact time period. Cash budgets are used to calculate that whether there is adequate cash to carry on the daily operations or whether there is additional cash that is lying in an unproductive way.

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

an important element in avoiding delays in revenue collection. 5 See Herma R. de Zoysa, Cash Management, in Premchand (1990). 5 b. Outflows For cash management, the control of cash outflows, which is directly related to organizational arrangements for budget execution, can pose more difficulties than the control of cash inflows. However, issues related to cash management should not be …

Budgeting is the most basic and the most effective tool for managing your money. Yet, most people avoid doing it because it is additional work, much like cutting your lawn or fixing the roof.

An important reason for producing a budget is that management is able to monitor the actual results against the budget. This is so that action can be taken to modify the operation of the organisation as time passes, or possibly to change the budget if it becomes unachievable. This is similar to the way that standard costing is used to monitor and control costs, and can be used alongside that

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

But before we get into the basics, let’s talk a bit about why a cash budget is important and what it should look like. Forecasting cash requirements and anticipated cash flow on a weekly, monthly, and yearly basis will give your business the tools to make better business decisions and head off problems before they arise.

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

A cash budget is a way to determine if a company has the cash necessary to meet upcoming obligations and to trigger corrective actions if a company’s actual figures don’t match the budget estimates. For example, a company experiencing cash-flow problems may need to borrow money in the short term for emergency equipment repairs, the payment of taxes or a monthly payroll. In addition, …

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

The Advantages of Preparing a Monthly Cash Budget Chron.com

What is a Cash Flow Budget (and Why Do You Need One

The preparation of a cash budget is an important management task. While some small businesses While some small businesses may be able to survive for a time without budgeting, savvy business owners will realize its importance.

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

Especially in the current turbulent economy, budgeting is more important than ever. If you and your family want financial security, following a budget is the only answer.

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

How to Create a Cash Budget to Improve Your Bottom Line

MERITS AND DEMERITS OF CASH BUDGET The successor

Why good financial management is important for not-for-profits 2 Glossary of terms 3 Setting the scene for good financial management 5 Understanding financial statements 5 Analysing the financial health of an organisation 13 Record keeping for improved financial information 16 Budgeting and forecasting 17 Financial management 27 Managing profitability and cash flow 27 Working capital

It is the importance of budgetary control that with this, we can use the forecasting techniques. Three departments work hard for calculating best estimation of future.

Cash flow budget which shows the amount of cash necessary to support the operating budget. It is of great importance that the business has sufficient funds to support the planned operational budget. It is of great importance that the business has sufficient funds to support the planned operational budget.

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

Cash flow forecasting is one of the most important forecasting tools for business and can also help you keep on top of your bills. It is very useful when seeking finance, as it shows lenders you have the capacity to pay them back.

How to Create a Cash Budget to Improve Your Bottom Line

What is a Cash Flow Budget (and Why Do You Need One

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

An important reason for producing a budget is that management is able to monitor the actual results against the budget. This is so that action can be taken to modify the operation of the organisation as time passes, or possibly to change the budget if it becomes unachievable. This is similar to the way that standard costing is used to monitor and control costs, and can be used alongside that

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

A cash budget is very important, especially for smaller companies. It allows a company to establish the amount of credit that it can extend to customers without having problems with liquidity. A cash budget helps avoid a shortage of cash during periods in which a company encounters a …

How to Create a Cash Budget to Improve Your Bottom Line

Cash budget What is a cash budget? Debitoor invoicing

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

conceptions of cash budgeting as a system of budgeting in which control totals are defined wholly or primarily as limits on payments, and of cash/commitments budgeting (as, for example, in the Argentine, French and United States systems) as a system in which control

A cash budget is very important, especially for smaller companies. It allows a company to establish the amount of credit that it can extend to customers without having problems with liquidity. A cash budget helps avoid a shortage of cash during periods in which a company encounters a …

Budgets can be used for estimating the financial results, financial position, and cash flows of a business as of various dates in the future. As an auditor, I have seen some businesses prepare a budget for the income statement only. However, I find that it is also very important to budget for the balance sheet and cash flows as well. This will help you see the whole picture of what is to come

an important element in avoiding delays in revenue collection. 5 See Herma R. de Zoysa, Cash Management, in Premchand (1990). 5 b. Outflows For cash management, the control of cash outflows, which is directly related to organizational arrangements for budget execution, can pose more difficulties than the control of cash inflows. However, issues related to cash management should not be …

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

PURPOSE FOR BUDGETING the budget is the most important tool in conducting any activity successfully. A budget is the tool by which a company’s management translates into action the corporate strategies and quantitative mission statements. Keywords: budgets, budgeting, performance. J.E.L. classification: G31, G39 1. INTRODUCTION The existence, development and environmental …

A cash budget is a way to determine if a company has the cash necessary to meet upcoming obligations and to trigger corrective actions if a company’s actual figures don’t match the budget estimates. For example, a company experiencing cash-flow problems may need to borrow money in the short term for emergency equipment repairs, the payment of taxes or a monthly payroll. In addition, …

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

A cash budget details the anticipated cash receipts and cash disbursements for the time period covered in the budget. The cash budget includes the amount of projected financing the company will need during that time period.

How to Create a Cash Budget to Improve Your Bottom Line

The Importance of Cash Boundless Finance

Budgeting is the most basic and the most effective tool for managing your money. Yet, most people avoid doing it because it is additional work, much like cutting your lawn or fixing the roof.

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

A cash budget details the anticipated cash receipts and cash disbursements for the time period covered in the budget. The cash budget includes the amount of projected financing the company will need during that time period.

Budgets can be used for estimating the financial results, financial position, and cash flows of a business as of various dates in the future. As an auditor, I have seen some businesses prepare a budget for the income statement only. However, I find that it is also very important to budget for the balance sheet and cash flows as well. This will help you see the whole picture of what is to come

It is the importance of budgetary control that with this, we can use the forecasting techniques. Three departments work hard for calculating best estimation of future.

10 Benefits of Budgeting Your Money Budgeting Income

The Advantages of Preparing a Monthly Cash Budget Chron.com

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

Cash flow forecasting is one of the most important forecasting tools for business and can also help you keep on top of your bills. It is very useful when seeking finance, as it shows lenders you have the capacity to pay them back.

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

The Purpose of a Cash Budget Cash budget means to compute approximately the inflows and outflows of cash for an entity or business for an exact time period. Cash budgets are used to calculate that whether there is adequate cash to carry on the daily operations or whether there is additional cash that is lying in an unproductive way.

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

A cash budget is a prediction of future cash receipts and expenditures for a particular time period, usually in the near future. The cash flow budget helps the business determine when its income will be sufficient to cover its expenses and when the company will need to seek outside financing.

Budgets form an important part of planning and control. They can be used as a tool They can be used as a tool for future planning as well as a tool for exercising control over cash receipts and

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

A cash budget is a way to determine if a company has the cash necessary to meet upcoming obligations and to trigger corrective actions if a company’s actual figures don’t match the budget estimates. For example, a company experiencing cash-flow problems may need to borrow money in the short term for emergency equipment repairs, the payment of taxes or a monthly payroll. In addition, …

equally important, therefore, for organisations to budget for future financing needs so that the funding process can be planned and achieved as smoothly and efficiently as possible. Cash budgets are vital to the management of cash.

The Importance of Cash Boundless Finance

Why Is Cash Budgeting Important to the Organization

Budgets form an important part of planning and control. They can be used as a tool They can be used as a tool for future planning as well as a tool for exercising control over cash receipts and

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

18/06/2015 · Merits/advantages – It helps the management to concentrate their attention on significant matters that is Not proceeding according to plan. – It helps to improve communication, better understanding and harmonious relationship among the employees.

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

A cash budget is very important, especially for smaller companies. It allows a company to establish the amount of credit that it can extend to customers without having problems with liquidity. A cash budget helps avoid a shortage of cash during periods in which a company encounters a …

Creating a monthly cash budget makes it easier to prepare this important document. By estimating your monthly income and outgo, you will be much better equipped to predict the company’s income for

The cash budget is one of the primary tools used in short-term financial planning in order to plan for cash flow. It is often developed on a month-by-month basis. A good cash budget allows the owner to see short-term financial needs and opportunities for the business. One month, the firm may have extra cash and may be able to save some money in a money market fund or take advantage of a

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

Cash budget What is a cash budget? Debitoor invoicing

What Is the Primary Purpose of a Cash Budget? Your Business

It is the importance of budgetary control that with this, we can use the forecasting techniques. Three departments work hard for calculating best estimation of future.

A cash budget is a way to determine if a company has the cash necessary to meet upcoming obligations and to trigger corrective actions if a company’s actual figures don’t match the budget estimates. For example, a company experiencing cash-flow problems may need to borrow money in the short term for emergency equipment repairs, the payment of taxes or a monthly payroll. In addition, …

11. Cash Budget 12. Capital expenditures budget 13. Budgeted balance sheet. 140 CHAPTER EIGHT • Comprehensive Business Budgeting A diagram of the budget components is shown in Figure 8.3 This figures shows the logical order in which the budget process must follow. The budgeting process begins as shown in the diagram with the sales forecast and ends with the budgeted balance sheet. …

The preparation of a cash budget is an important management task. While some small businesses While some small businesses may be able to survive for a time without budgeting, savvy business owners will realize its importance.

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

Budgeting is the most basic and the most effective tool for managing your money. Yet, most people avoid doing it because it is additional work, much like cutting your lawn or fixing the roof.

71 The Worksheet Area The Worksheet Area The worksheet area is not necessarily a part of the cash budget. However, it is useful because it summarizes some of the most important calcu lations in the budget.

Creating a monthly cash budget makes it easier to prepare this important document. By estimating your monthly income and outgo, you will be much better equipped to predict the company’s income for

Understanding Cash Budget. The other name of cash budget is finance budget. This budget is the most important of all the functional budgets. But, this budget is prepared after the preparation of all other functional budgets.

The Purpose of a Cash Budget Cash budget means to compute approximately the inflows and outflows of cash for an entity or business for an exact time period. Cash budgets are used to calculate that whether there is adequate cash to carry on the daily operations or whether there is additional cash that is lying in an unproductive way.

Be sure to check out part 1 about the benefits of a cash budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget. In that article I explain how cash is the ultimate tool to help you control your spending and staying within your budget.

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

What Is the Primary Purpose of a Cash Budget? Your Business

10 Benefits of Budgeting Your Money Budgeting Income

An important reason for producing a budget is that management is able to monitor the actual results against the budget. This is so that action can be taken to modify the operation of the organisation as time passes, or possibly to change the budget if it becomes unachievable. This is similar to the way that standard costing is used to monitor and control costs, and can be used alongside that

It is the importance of budgetary control that with this, we can use the forecasting techniques. Three departments work hard for calculating best estimation of future.

information will be important to managers, such as the identification of programmes, the objectives or outcomes of programmes, the types of goods and services produced, as well as indicators by which to judge the efficiency and effectiveness of programmes. • It is a system. Its role is to connect, accumulate, process, and then provide information to all parties in the budget system on a

A cash budget is a prediction of future cash receipts and expenditures for a particular time period, usually in the near future. The cash flow budget helps the business determine when its income will be sufficient to cover its expenses and when the company will need to seek outside financing.

PURPOSE FOR BUDGETING the budget is the most important tool in conducting any activity successfully. A budget is the tool by which a company’s management translates into action the corporate strategies and quantitative mission statements. Keywords: budgets, budgeting, performance. J.E.L. classification: G31, G39 1. INTRODUCTION The existence, development and environmental …

This illustrates why it is important to regularly update the cash flow budget, as inflows and expenditures may change. For more information on the importance of cash flow, read our article, “ Basic Accounting for Trucking Companies .”

Especially in the current turbulent economy, budgeting is more important than ever. If you and your family want financial security, following a budget is the only answer.

INTRODUCTION: We review client cash flow forecasts regularly and one of the main reasons why the budgets do not match the actuals is because they have usually missed some basic components.

an important element in avoiding delays in revenue collection. 5 See Herma R. de Zoysa, Cash Management, in Premchand (1990). 5 b. Outflows For cash management, the control of cash outflows, which is directly related to organizational arrangements for budget execution, can pose more difficulties than the control of cash inflows. However, issues related to cash management should not be …

budgeting. A tactical perspective is especially important A tactical perspective is especially important during times of uncertainty: the incidence and behavior of

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

Cash flow budget which shows the amount of cash necessary to support the operating budget. It is of great importance that the business has sufficient funds to support the planned operational budget. It is of great importance that the business has sufficient funds to support the planned operational budget.

Why good financial management is important for not-for-profits 2 Glossary of terms 3 Setting the scene for good financial management 5 Understanding financial statements 5 Analysing the financial health of an organisation 13 Record keeping for improved financial information 16 Budgeting and forecasting 17 Financial management 27 Managing profitability and cash flow 27 Working capital

The Purpose of a Cash Budget Cash budget means to compute approximately the inflows and outflows of cash for an entity or business for an exact time period. Cash budgets are used to calculate that whether there is adequate cash to carry on the daily operations or whether there is additional cash that is lying in an unproductive way.

Creating a monthly cash budget makes it easier to prepare this important document. By estimating your monthly income and outgo, you will be much better equipped to predict the company’s income for

The preparation of a cash budget is an important management task. While some small businesses While some small businesses may be able to survive for a time without budgeting, savvy business owners will realize its importance.

What is a Cash Flow Budget (and Why Do You Need One

Budgets can be income budgets for money received, eg a sales budget, or expenditure budgets for money spent, eg a purchases budget. The budget we shall be focusing on in this chapter is the cash budget , which combines both income

Cash budget What is a cash budget? Debitoor invoicing

The Advantages of Preparing a Monthly Cash Budget Chron.com

10 Benefits of Budgeting Your Money Budgeting Income

Cash budget is an extremely important tool available in the hands of a finance manager for planning fund requirements and for controlling cash position in the firm. As a planning device, cash budget helps the finance manager to know in advance the cash position of the firm in different time periods.

The Advantages of Preparing a Monthly Cash Budget Chron.com

Why Is Cash Budgeting Important to the Organization

MERITS AND DEMERITS OF CASH BUDGET The successor

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

Why Is Cash Budgeting Important to the Organization

Why a Cash Budget is Important & What It Should Look Like

The Importance of Cash Boundless Finance

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

The Importance of Cash Boundless Finance

The primary purpose of a cash budget, also known as a cash flow projection, is to help you plan and strategize to be able to cover upcoming expenses. The process of listing anticipated expenses and anticipated cash on hand, and then comparing the two amounts, …

What is a Cash Flow Budget (and Why Do You Need One

10 Benefits of Budgeting Your Money Budgeting Income

Why Is Cash Budgeting Important to the Organization

directors of the largest organisations emphasise the importance of cash, and cash flow modelling is a fundamental part of any private equity buy-out. In a credit crunch environment, where access to liquidity is restricted, cash management becomes critical to survival. In its simplest form, cash flow is the movement of money in and out of your business. It is not profit and loss, although

What Is the Primary Purpose of a Cash Budget? Your Business

Why a Cash Budget is Important & What It Should Look Like

Budgets form an important part of planning and control. They can be used as a tool They can be used as a tool for future planning as well as a tool for exercising control over cash receipts and

10 Benefits of Budgeting Your Money Budgeting Income

What is a Cash Flow Budget (and Why Do You Need One

Why a Cash Budget is Important & What It Should Look Like